Find Off Market Real Estate Investments

Before anyone else.

Uncover hidden real estate gems with big upside potential using our predictive prospecting.

Uncover hidden real estate gems with big upside potential using our predictive prospecting.

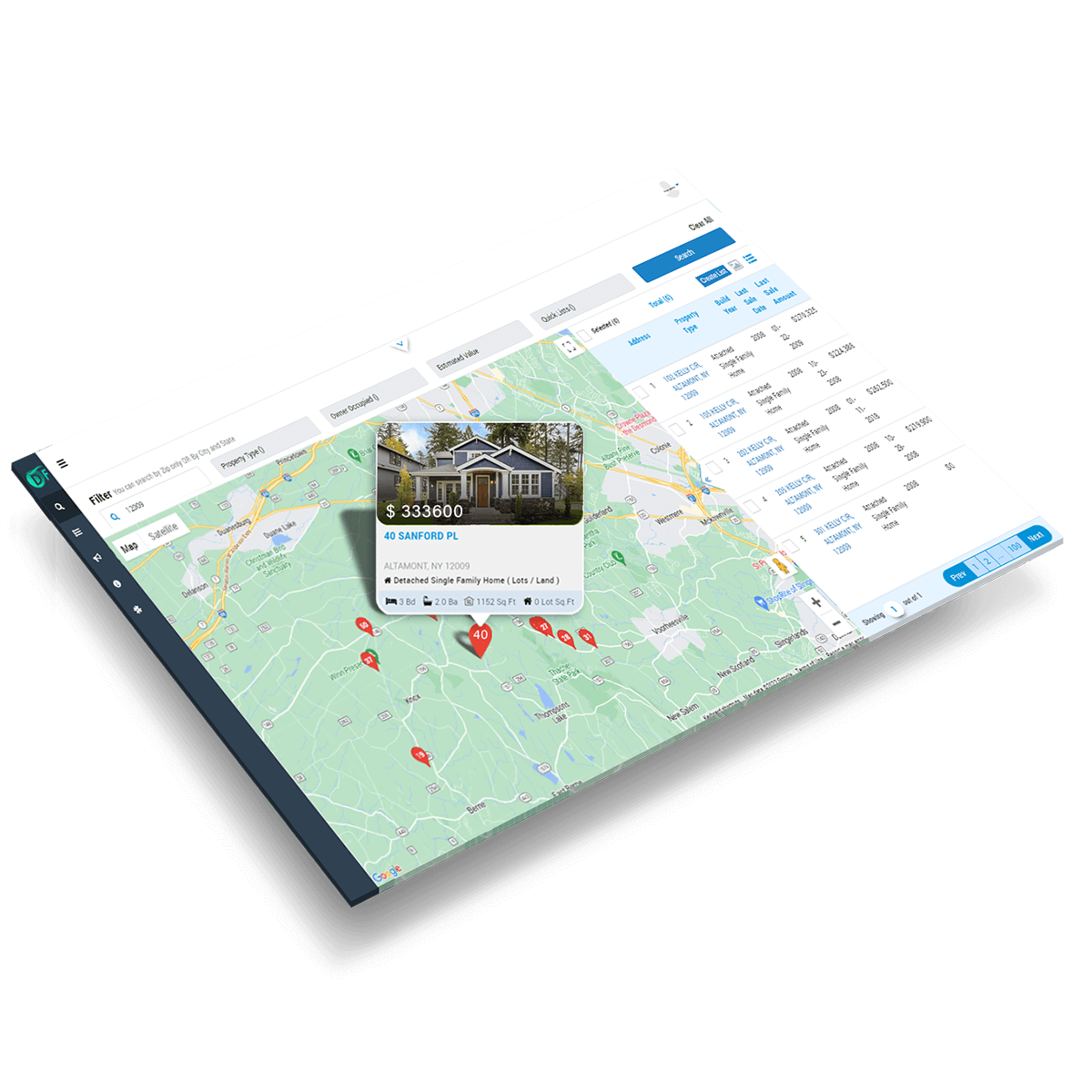

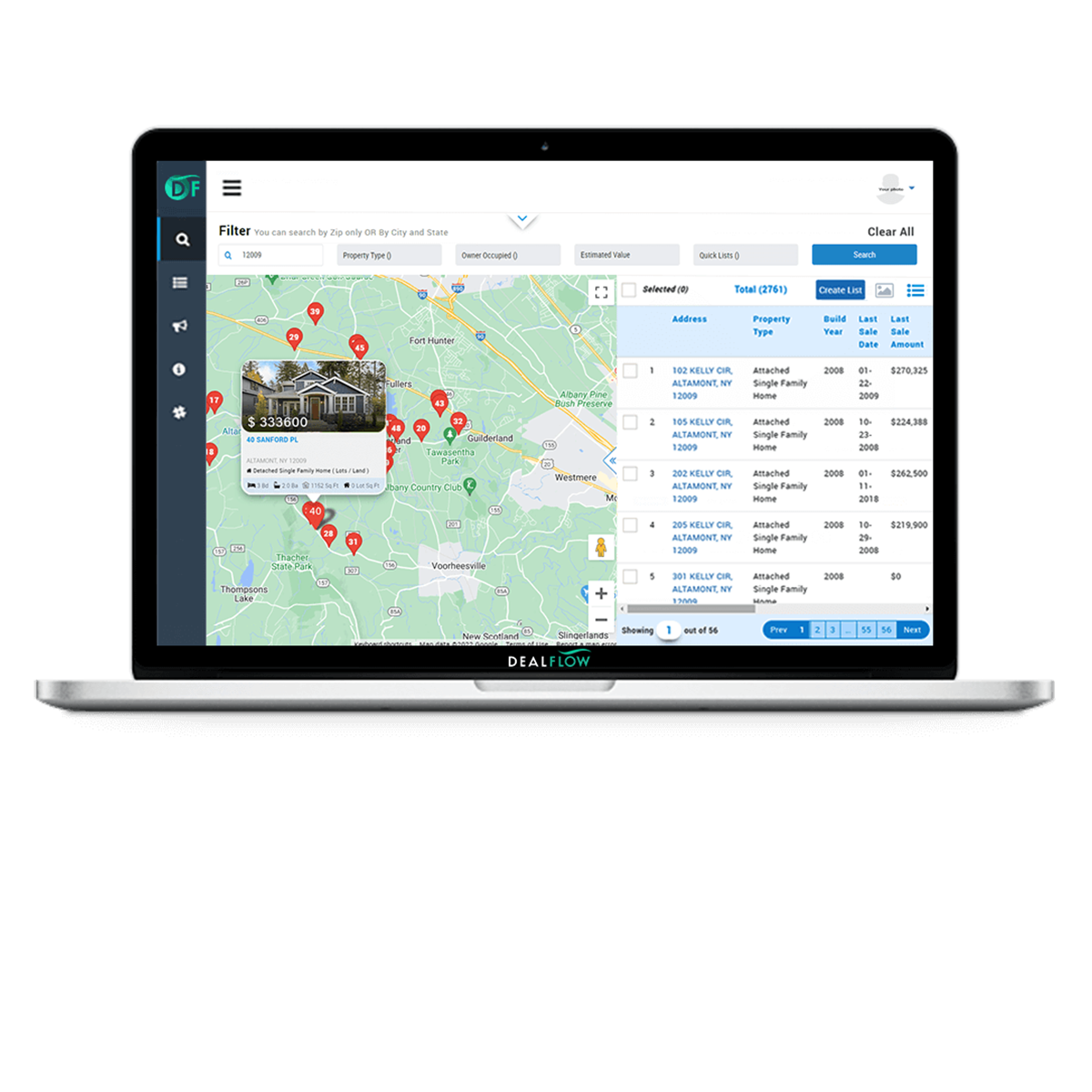

Deal Discovery at your fingertips powered by big data and predictive analytics.

This guide covers key considerations including finding and analyzing deals, understanding the market, negotiating deals, financing options, and management strategies. Whether you're interested in flipping houses, becoming a landlord, or developing a real estate portfolio, this book provides the foundational knowledge you need to get started on the path to success.

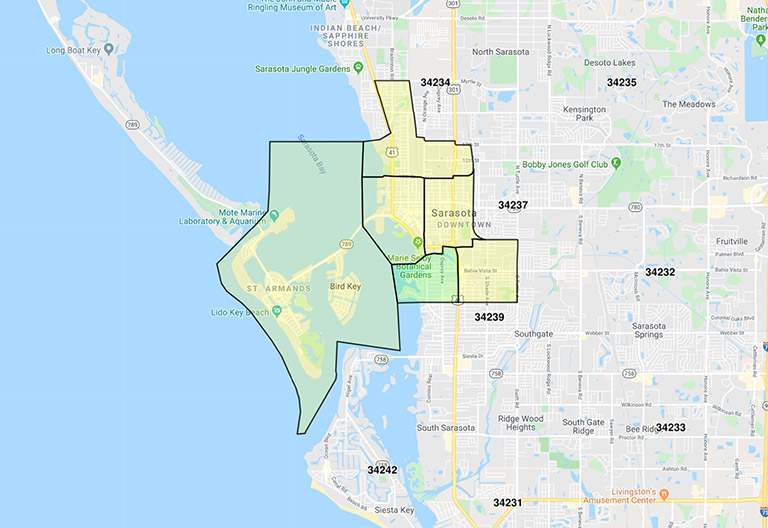

When you have data-backed listing predictions, you can concentrate on the people who matter most. With SmartTargeting, your "farm" isn't just a ZIP code. It's a narrowed list of the best realtor leads of homeowners most likely to sell.

If you're interested in getting started in real estate investing, there are several steps you can take to start building your portfolio. Here are some tips to help you get started:

Real estate investing can be a rewarding and profitable way to build wealth, but it's important to approach it carefully and with a solid plan in place. By educating yourself, developing a plan, and carefully evaluating properties, you can increase your chances of success and minimize your risks.

The 2% rule is a guideline often used by real estate investors to determine whether a property is worth investing in. The rule says that the monthly rent for a property should be at least 2% of the purchase price. For example, if a property is purchased for $100,000, the monthly rent should be at least $2,000. This rule is intended to help investors determine whether a property will be able to generate enough income to cover the costs of owning and maintaining it. However, it is important to note that the 2% rule is just a guideline and may not be applicable in all situations. It is always a good idea to carefully evaluate the potential costs and benefits of an investment property before making a decision.

The 50% rule states that on average half the income of a cash generating property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits. For example, a rental property that generates $40,000 annually in gross rents would spend $20,000 of that to cover expenses, according to the 50% rule. The remaining $20,000 would represent net operating income. Common property expenses include property taxes, insurance, vacancy losses, maintenance and repairs, and utilities. It should not include debt service or property management fees.

The 70% rule can help flippers when they're scouring real estate listings for potential investment opportunities. Basically, the rule says real estate investors should pay no more than 70% of a property's after-repair value (ARV) minus the cost of the repairs necessary to renovate the home. Using the 70% rule is simple. You multiply the property's ARV by 0.7 to determine the maximum price you would pay for that property. For example, if you estimate that a property's ARV will be $300,000, this means that you should spend no more than $210,000.

In the United States, short-term rental income is typically taxed as ordinary income. This means that the income you earn from renting out your property for short periods of time, such as a few days or weeks, is subject to the same tax rates as your other earned income, such as wages or salary.

However, there are some exceptions and special rules that may apply to the taxation of short-term rental income. For example, if you rent out your property for fewer than 15 days per year, you are not required to report the income on your tax return. Additionally, if you use the property as your primary residence for part of the year and rent it out for the rest of the year, you may be able to exclude some of your rental income from tax using the "home rental exclusion" rule.

It's important to note that in addition to income tax, you may also be subject to other taxes on your short-term rental income, such as local hotel or occupancy taxes. You should consult with a tax professional or the IRS for more information on the specific taxes that may apply to your situation.

In the United States, long-term rental income is typically taxed as passive income. This means that the income you earn from renting out your property for extended periods of time, such as several months or years, is not subject to the same tax rates as your earned income from wages or salary. Instead, it is subject to a lower tax rate, which may be beneficial for some taxpayers.

However, there are some exceptions and special rules that may apply to the taxation of long-term rental income. For example, if you actively manage the property, such as by hiring a property manager or making decisions about repairs and maintenance, the income may be treated as active income and subject to higher tax rates. Additionally, if you use the property as your primary residence for part of the year and rent it out for the rest of the year, you may be able to exclude some of your rental income from tax using the "home rental exclusion" rule.

It's important to note that in addition to income tax, you may also be subject to other taxes on your long-term rental income, such as local property taxes. You should consult with a tax professional or the IRS for more information on the specific taxes that may apply to your situation.

There are several ways that you can reduce your tax liability from real estate profits. Some common strategies include taking advantage of tax deductions and credits, using tax-advantaged retirement accounts to invest in real estate, and structuring your real estate investments in a way that minimizes your tax burden.

One of the most effective ways to reduce your tax liability from real estate profits is to take advantage of deductions and credits that are available for real estate investments. For example, you may be able to deduct the costs of maintaining and improving your property, such as repairs and renovations, from your taxable income. You may also be able to claim credits for energy-efficient improvements to your property, or for purchasing a property in a designated low-income area.

Another way to reduce your tax liability from real estate profits is to use tax-advantaged retirement accounts, such as a self-directed IRA or 401(k), to invest in real estate. These accounts allow you to invest in real estate and other alternative assets, and the income and gains from these investments are typically tax-deferred or tax-free. This can provide significant tax savings over the long-term.

Finally, you can also minimize your tax liability by structuring your real estate investments in a way that takes advantage of tax-efficient investment vehicles, such as partnerships or limited liability companies. These structures can allow you to distribute income and losses among the members of the partnership or LLC in a way that minimizes your overall tax burden. It's important to consult with a tax professional to determine the best strategy for reducing your tax liability from real estate profits.

Real estate investors can lose money in a variety of ways. Some common causes of losses in real estate investing include buying properties at inflated prices, failing to properly evaluate the condition or potential of a property, and not properly managing the property or the tenant relationship.

One of the biggest risks in real estate investing is buying a property at an inflated price. This can happen when an investor gets caught up in the excitement of a hot market and overpays for a property, or when an investor doesn't conduct thorough market research and doesn't realize the true value of a property. When this happens, the investor may not be able to generate sufficient rental income or sell the property for a profit, resulting in a loss.

Another common way that real estate investors lose money is by failing to properly evaluate the condition or potential of a property. This can happen when an investor doesn't conduct a thorough inspection of the property or doesn't take the time to research the local market and understand the property's potential for rental income or appreciation. If an investor buys a property without fully understanding its condition or potential, they may be in for a rude awakening when they discover that the property needs significant repairs or isn't in a desirable location.

Real estate investors can also lose money if they don't properly manage the property or the tenant relationship. This can include failing to screen tenants properly, not enforcing the terms of the lease agreement, or not properly maintaining the property. If an investor doesn't take the time to properly manage their property and tenants, they may face costly repairs, eviction expenses, or other unexpected expenses that can eat into their profits and lead to losses.

Institutional real estate investors are typically large organizations with significant resources and experience in the real estate market. As a result, retail real estate investors can learn a lot from their strategies and approaches. Some of the key things that retail investors can learn from institutional investors include the importance of conducting thorough market research and due diligence, the value of building a diversified portfolio, and the need to develop strong relationships with key industry players. Additionally, institutional investors often have access to professional management teams and sophisticated financial modeling tools, which can provide valuable insights and guidance for retail investors. Ultimately, studying the strategies and approaches of institutional investors can help retail investors make more informed decisions and improve their chances of success in the real estate market.

There are several types of financing available to real estate investors. The most common types of financing include traditional loans from banks or other financial institutions, private loans from individual investors, and government-backed loans such as those offered through the Small Business Administration (SBA). Additionally, real estate investors can often leverage the equity in their existing properties to obtain financing for new investments. In some cases, investors may also be able to secure financing through joint ventures or partnerships with other investors. The type of financing that is best for a particular investor will depend on their specific needs and circumstances. It is important for investors to carefully consider their options and consult with financial advisors to determine the best financing solution for their situation.

A hard money loan is a type of short-term financing that is often used by real estate investors. These loans are typically provided by private investors or companies, rather than traditional financial institutions such as banks. Hard money loans are typically secured by the property being purchased, and may have higher interest rates and more stringent terms than traditional loans. Hard money loans are often used by investors to quickly acquire a property, with the intention of refinancing the loan with a more traditional lender at a later date. These loans are typically used when a property is in need of significant repairs or renovations, and may not qualify for traditional financing. Overall, hard money loans can be a useful financing option for real estate investors, but they should be carefully considered and used only as a last resort in most cases.

Investing in rental properties can be a lucrative venture, providing a stable income stream and long-term wealth accumulation. However, to maximize your potential returns and make informed investment decisions, it is crucial to carefully evaluate potential rental properties.

Read Story

Investing in real estate, particularly rental properties, can be a lucrative way to grow your wealth over time. However, it requires careful planning, analysis, and execution to build a successful real estate portfolio.

Read Story

Investing in real estate can be an exciting and potentially lucrative venture. The promise of passive income, wealth creation, and financial freedom often lures new investors into the realm of real estate. However, navigating this complex and dynamic industry requires knowledge, careful planning, and avoiding common pitfalls.

Read Story

Investing in rental properties can be a lucrative venture, but understanding what tenants truly desire is crucial for success. This guide aims to provide property investors with a comprehensive understanding of tenant preferences, enabling them to make informed decisions when acquiring and managing rental properties.

Read Story

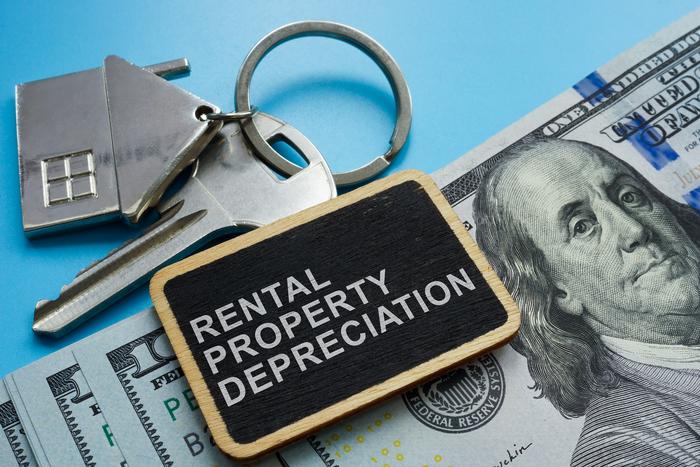

Owning a rental property can be a lucrative investment, but it also comes with various financial responsibilities. One of the essential aspects of managing rental properties is understanding how to handle depreciation. Depreciation allows you to deduct the cost of wear and tear on your property over time, reducing your taxable income and increasing your potential for long-term financial gains.

Read Story

House hacking can come in several forms. It could mean you have a single-family dwelling and you rent out a guest bedroom. Or maybe you own a duplex and rent out one side to someone else. Either way, that’s what house hacking is.

Read Story

The best deals aren't published. As any smart investor knows, you have to go below the surface to find off-market opportunities that make it possible to close without competition. What is an off-market listing? Off-market real estate refers to any property that is being sold outside of the conventional "listing" process.

Read Story

Real estate investing is the process of acquiring, owning, managing, renting, and/or selling real estate for profit. It can be a great way to build wealth, generate passive income, and achieve financial freedom. However, it is also a complex and challenging endeavor that requires a great deal of knowledge, experience, and expertise.

Read Story

This Real Estate Investor FAQ blog covers questions on How to: get started in real estate investing, Types of real estate investors, Real estate wholesaler, short-term rental income, reducing your tax liability, types of financing, and hard money loan.

Read Story

Many who are interested in real estate investing want to get into the house-flipping business. It looks fun, and if you watch all the flipping shows on television, you might even think that it’s easy.

Read Story

Are you considering turning a property you already own into a short-term rental? Perhaps you are a real estate investor actively looking for properties that would fit well in this niche. Regardless, you will need to make sure you know the ins and outs of these types of rental properties before getting started.

Read Story

Anyone interested in real estate investment has probably come across multiple ways to get started. Some people flip houses, while others rent out properties. Another method to make money with real estate is through wholesaling.

Read Story